Collecting trading cards is part hobby, part financial market. One clear sign of market forces in the hobby is the price gap between raw (ungraded) cards and slabbed cards. Slabbed cards are professionally graded. Raw cards are ungraded, while slabbed cards are professionally graded. This article explains why graded cards typically sell for more. It discusses what value grading actually adds. It also covers the important differences between the grading companies that influence price and collector preference. The goal is practical. By the end, you should understand the economic logic behind grading. You will learn when grading adds real value. You will also find out how to choose a grading path that fits your cards and your goals.

The core reasons graded cards are worth more

1. Goal, standardized condition assessment

The single most important role of a grading company is to offer an independent, repeatable assessment of a card’s condition. Raw cards are evaluated subjectively by buyers and sellers. A “9” to one person is an “8.5” to another. A grade from a well-known third party transforms that subjective assessment. It becomes an factual claim that both buyer and seller can rely on. This reduces a major source of friction in transactions. It also lowers the perceived risk of overpaying for a card in poorer condition than advertised.

2. Authentication and counterfeit protection

Grading companies authenticate cards and, for autographed items, verify signatures. Given the sophistication of counterfeits and reprints in some segments, counterfeiting and reprints have become sophisticated. An expert third party confirming authenticity materially increases buyer confidence. That authentication premium can be larger than the premium for condition alone when provenance or counterfeiting risk is meaningful.

3. Market liquidity and buyer pool expansion

Slabbed cards are easier to sell, especially on larger marketplaces and at auction houses that prefer or need third-party grading. A graded card attracts a wider bidder base. This includes institutional buyers, investors, and overseas collectors. Thus, it typically fetches a higher and more predictable price. Liquidity matters: buyers will pay a premium to avoid the time and uncertainty of verifying condition themselves.

4. Price discovery and comparable sales

Because grading provides a common scale (e.g., “PSA 10,” “BGS 9.5”), it makes it possible to compare sales across time and venues. Aggregated sale data for specific grades creates benchmarks. When a card has many graded examples, price discovery improves and sellers can confidently price compared to known comparable sales. That certainty translates into higher, steadier market values.

5. Preservation, presentation, and perceived permanence

Encapsulation in a tamper-proof holder protects the card and signals permanence. A slab communicates that the card has been professionally handled and preserved; that presentation alone shifts buyer perception. For gift buyers, show collectors, and investors, that “finished product” appeal is a real economic factor.

6. Psychological and speculative effects

Grading has a psychological dimension: the “10” grade is a status signal. For modern rookies or scarce parallels, a PSA/BGS 10 can create scarcity perception that fuels speculative demand. Market psychology can thus amplify the grading premium beyond the intrinsic value added by authentication and protection.

When grading doesn’t add value (and can cost you money)

Grading isn’t a universal value-add. Consider these situations:

- Common low-value cards: If the raw market price of a card is lower than the grading fee, grading destroys value. This is due to extra costs like shipping and potential resale commission.

- Cards with uncertain market: Niche issues with few buyers will not see a grading premium. This is because there’s no larger buyer pool willing to pay for the slab.

- Cards where condition is irrelevant: Some vintage issues or misprints are collected regardless of centering or minor surface wear. Grading will not substantially change the price.

- Cards unlikely to improve in grade: If you know your card has clear flaws, they will prevent a top grade. Thus, the cost of grading is not justified. You consider grading only if authentication alone is needed.

A cost-benefit analysis should precede every submission. Include grading fees, shipping, potential insurance, and marketplace commissions in your calculations.

Key grading companies and how they differ

There are multiple professional graders in the market; a handful dominate price-setting. Each has strengths that affect how the market values the same card graded by different services.

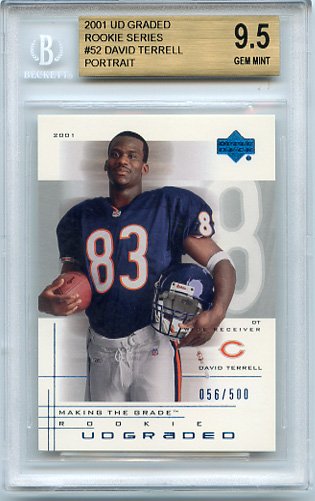

PSA (Professional Sports Authenticator)

- Market perception: PSA is often seen as the benchmark, especially for modern sports and non-sports card collecting. PSA-population reports and pricing references (PSA 10 sales) exert strong influence on market prices.

- Strengths: Wide market recognition, deep historical sales data, and broad acceptance by auction houses and marketplaces.

- Typical pricing effect: Many cards command a premium when graded PSA. This is especially true for modern high-grade rookies and popular inserts. Higher grades increase the premium.

- Considerations: PSA has had periods of significant submission volume. This can increase turnaround times. Historically, it led to debates over grading consistency. Their holders and labels are widely recognizable, which itself adds value.

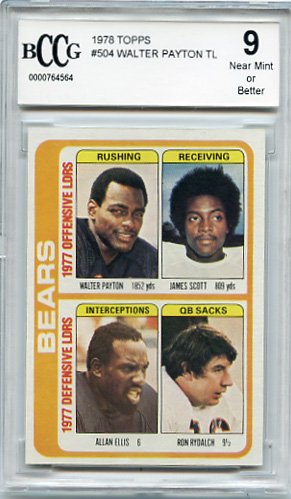

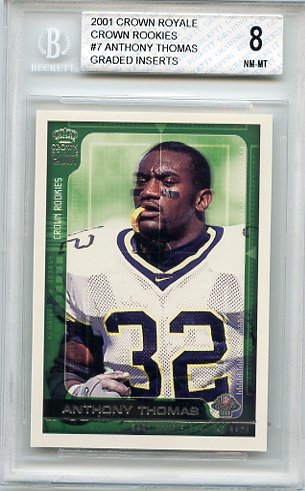

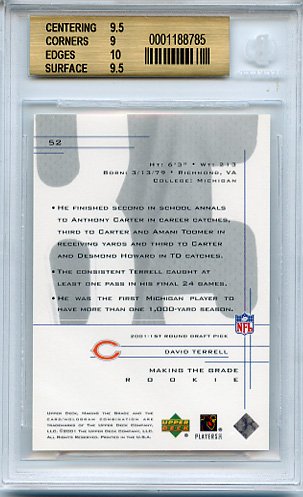

BGS / Beckett Grading Services

- Market perception: BGS is particularly respected in the modern card market and among hobbyists who value the company’s “subgrade” system.

- Strengths: BGS provides subgrades (centering, corners, edges, surface), and their 9.5 “Gem Mint” black label is highly coveted. BGS often grades modern cards (e.g., modern basketball, football, baseball rookies) and is favored for cards where centering is critical.

- Typical pricing effect: For many modern cards, a BGS 9.5—especially with a 10 in surface and high subgrades—can sell at or above PSA prices. BGS is also preferred for autograph verification where Beckett’s autograph grading and sticker system matter.

- Considerations: The subgrade detail appeals to technical buyers who want more nuance than a single grade. BGS holders are thicker and visually distinct.

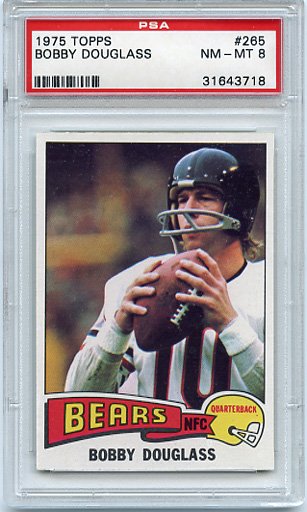

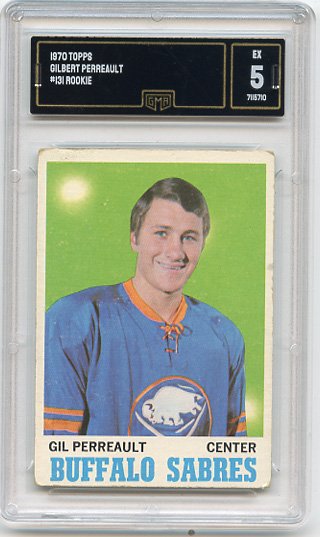

SGC (Sportscard Guaranty)

- Market perception: SGC enjoys strong respect among vintage and pre-war card collectors. Their grayscale labels and different aesthetic sometimes appeal to premium vintage markets.

- Strengths: SGC historically graded many vintage and high-value classic cards and developed reputational expertise on older issues.

- Typical pricing effect: For some vintage cards, SGC grades are preferred. They can command comparable premiums to PSA depending on the collector segment. SGC can sometimes be more consistent in grading centering and wear for older cards.

- Considerations: Market preference is regional or segment-specific. Some buyers strongly prefer SGC for pre-war sets. Others default to PSA.

Other graders

There are smaller and emerging grading houses with niche appeal (e.g., regional, sport-specific, or specialized for non-sports like Pokémon, Magic: The Gathering, or entertainment cards). These companies can add value when they enjoy collector trust. Still, they typically command lower premiums than the big three. This remains true until they build a track record.

Practical differences that affect value

Labeling and holder differentiation

Collectors recognize different labels and slabs instantly. This recognition affects resale; a PSA slab will attract more syndicated bidders than a lesser-known grader. The aesthetic and perceived tamper resistance of the holder also drives buyer confidence.

Population reports and census data

Companies publish population reports that show how many cards of a given grade exist. A low census for a specific grade increases scarcity and price. PSA’s population report is widely referenced; BGS and SGC reports are also used by informed buyers.

Subgrades and nuance

BGS’s subgrade system introduces nuance that can both increase and decrease value. Two BGS 9.5s may have different subgrade profiles. If the surface subgrade is high, it can command a premium among buyers. These buyers care about play wear.

Market segmentation: vintage vs. modern

Collectors of vintage cards and modern cards often favor different graders. For example, a pre-war baseball card in an SGC holder might be as valuable as a PSA slab. A 2020 rookie autograph might be most valuable in PSA or BGS. This depends on the sport and community.

Turnaround, service tiers, and time sensitivity

Faster service options cost more. For cards expected to appreciate quickly (e.g., a newly drafted player), paying for expedited grading can be justified. Longer turnaround windows also affect market supply timing, which can change realized prices.

Submission strategy: maximize expected value

- Research comparable sales by grade and grader. Look up recent sales in marketplaces and auction records for the same card and grade across PSA/BGS/SGC. Price differences can be significant.

- Estimate net proceeds. Subtract grading fees, shipping/insurance, and platform commissions from the expected sale price by grade to decide whether grading is profitable.

- Focus on high-value and high-grade candidates. Grade only those cards where the expected premium exceeds submission expenses.

- Consider split submissions. If a card is worth grading, but you’re unsure which service will produce the best result. Try sending equivalent copies to different graders. This approach helps to decide which service provides the best assessment. This helps to see market reactions, and is useful for bulk or duplicate cards.

- Use authentication-only when relevant. If a card’s value depends on signature verification, select a service known for strong autograph authentication. Do this instead of focusing on a high grade.

- Time submissions to market catalysts. For rookies or newly discovered cards, grade near market windows (e.g., after a breakout season) when demand is highest.

Final thoughts: grading is a market instrument, not a magic wand

Grading converts subjective condition into an unbiased, market-acceptable credential and provides authentication and protection. That alone explains most of the price differential between graded and raw cards. But grading is not an automatic value multiplier for every card. The real value depends on several factors. These include the card’s demand and the specific grader’s market credibility for that card type. It also depends on the grade achieved and the relative costs of submitting.

For serious sellers and investors, treat grading as a financial decision. Analyze comparable sales by grader and grade. Account for fees. Only send cards where grading materially improves liquidity, price, or sale certainty. For collectors focused on preservation and showing, grading provides presentation and peace of mind. These intangible benefits often justify the cost on their own.

Understanding how different grading companies are perceived in your collecting niche is half the battle. In many cases, the right grader for a card is the one the typical buyer trusts the most. Buyer trust determines the correct choice.